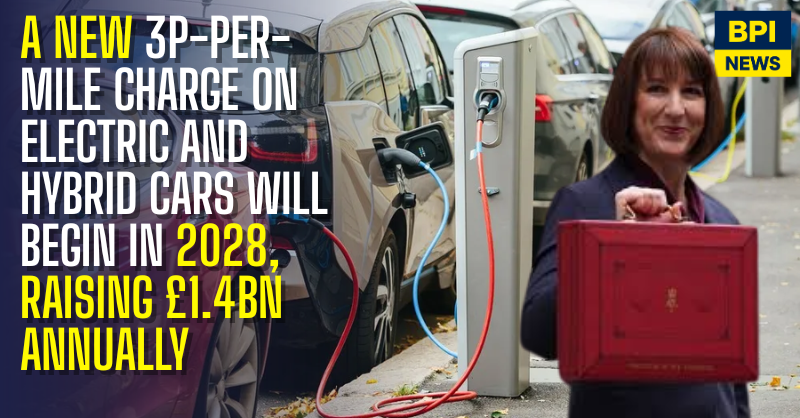

Electric and hybrid vehicle drivers will soon face a new pay-per-mile tax under Rachel Reeves budget reforms, marking a major shift in how Britain taxes road use.

According to the Office for Budget Responsibility’s (OBR) post-budget analysis, the new system will take effect from April 2028, applying a 3p-per-mile charge on electric and plug-in hybrid vehicles. The rate is set at around half the fuel duty currently paid by petrol car drivers and will rise annually in line with inflation.

The OBR projects the measure will raise £1.4 billion per year once implemented.

The move is designed to address the growing shortfall in fuel duty revenue as more drivers transition to low-emission vehicles. Analysts have long warned that the rise of electric vehicles would erode the Treasury’s income from traditional fuel taxes estimated at over £25 billion annually before the EV boom.

Reeves’ introduction of a mileage-based charge marks the first time electric car users will pay a levy comparable to those driving petrol or diesel vehicles. The measure effectively ends a long-standing incentive for EV adoption, though the government says it remains committed to net zero goals.

Motoring groups have expressed concern that the move could undermine electric vehicle uptake, warning that the pay-per-mile model could discourage drivers considering switching from petrol to electric.

However, Treasury officials argue the charge is necessary to create a “fair and sustainable” road tax system.

Further details on how the mileage will be tracked and verified are expected to be published by the Department for Transport ahead of the 2028 rollout.